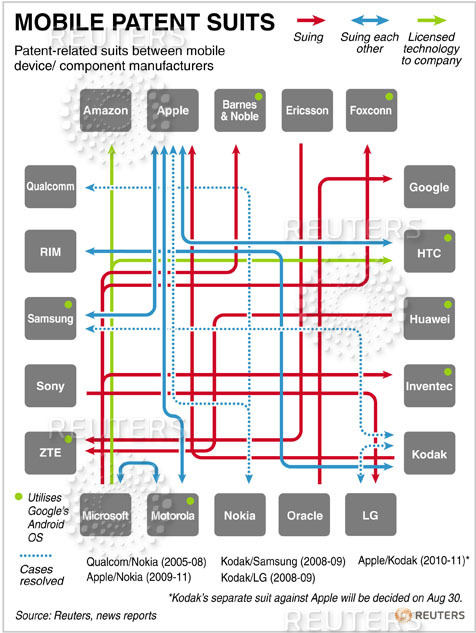

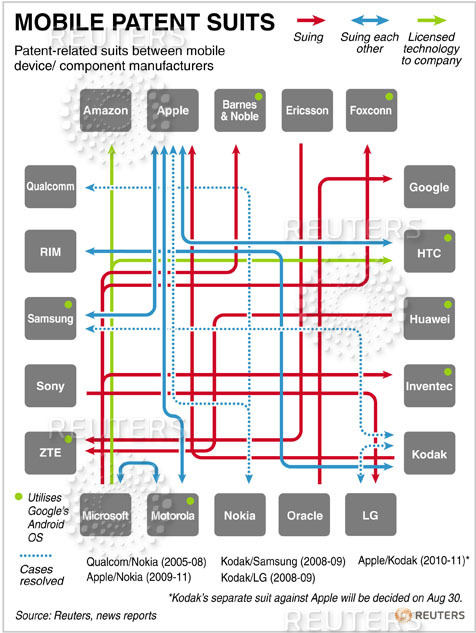

a simple diagram outlining exactly how fucked

A simple (!) diagram outlining exactly how fucked everything is in the world of mobile patents. Curiously missing is Intellectual Ventures.

A simple (!) diagram outlining exactly how fucked everything is in the world of mobile patents. Curiously missing is Intellectual Ventures.

Dan Frommer has a smart breakdown of the Kindle Cloud Reader

I read a few chapters via the Cloud Reader last night and didn’t have a single complaint, particularly when you save the app to your home screen to get rid of the browser chrome.

Dan’s point at the end about this being about making the best reader for every platform, not some petty war with Apple, is right on.

That would be uncouth.

—I love Sandy so damn much.

Affirmation and confirmation is a metaphorical cognitive carbohydrate. We seek it out because we’re more wired to affirm each other (to keep us in communities, I suspect) than to inform each other. We also seek it out because it feels better than confrontation.

The result? A new kind of hyper-informed ignorance. We’re not ignorant because we’ve consumed too little information anymore. We’re getting ignorant because we’ve consumed too much of the wrong information.

Affirmation and confirmation is a metaphorical cognitive carbohydrate. We seek it out because we’re more wired to affirm each other (to keep us in communities, I suspect) than to inform each other. We also seek it out because it feels better than confrontation.

The result? A new kind of hyper-informed ignorance. We’re not ignorant because we’ve consumed too little information anymore. We’re getting ignorant because we’ve consumed too much of the wrong information.

—Clay Johnson says [the most dangerous special interest group in America](http://www.quora.com/U-S-Politics/What-are-the-most-harmful-special-interests-in-the-US/answer/Clay-Johnson? snids =23873519#ans664637) is … us.

Network Link Conditioner in Xcode 4.1, Lion

A preference pane for simulating various network conditions (e.g. spotty WiFi or lossy 3G).

This is a super handy feature for doing mobile web development, either website or apps via the iOS simulator. [via Patrick Gibson]

Great piece of reporting by the Washington Post showing how the manufactured debt ceiling “crisis” came to be a political leverage for the Tea Party fueled GOP.

I thought I was being cynical when I thought the GOP was more interested in winning than actually governing. Sadly, that turns out to be true.

Unlike those in the lower half of the top 1%, those in the top half and, particularly, top 0.1%, can often borrow for almost nothing, keep profits and production overseas, hold personal assets in tax havens, ride out down markets and economies, and influence legislation in the U.S. They have access to the very best in accounting firms, tax and other attorneys, numerous consultants, private wealth managers, a network of other wealthy and powerful friends, lucrative business opportunities, and many other benefits. Most of those in the bottom half of the top 1% lack power and global flexibility and are essentially well-compensated workhorses for the top 0.5%, just like the bottom 99%. In my view, the American dream of striking it rich is merely a well-marketed fantasy that keeps the bottom 99.5% hoping for better and prevents social and political instability. The odds of getting into that top 0.5% are very slim and the door is kept firmly shut by those within it.

—

This is the view of an (anonymous) investment manager on the state of wealth in the U.S.. It’s a depressing read and doesn’t provide much reason to be optimistic that things are going to get any better, even (especially?) with the so-called socialist we have in the White House.

Particularly troubling is the bit about how cynical the people working on Wall Street are. According to this take, most are in it simply to cash out with as much money as possible in the shortest time possible, understand exactly why this a terrible thing not just for themselves but for the rest of the global economy and do absolutely nothing to fix this. The almost complete deregulation of the financial services industry, capped with the end of Glass-Steagall in 1999, has created a culture of greed and amorality that will only continue to hurt the other 99.9% of us.

Today is my last day at msnbc.com, where I’ve worked for the past seven and a half years. Tomorrow morning, my wife (!) and I are going to trek to the South Puget Sound to feast on Manila clams and oysters we dig ourselves.

Monday, I start working with my friends at Mule Design in San Francisco. We’re staying in Seattle until we get everything settled, find a new place to live (yes, we’d love your help finding a place!) and all of that, but will be packing up everything we absolutely need before you know it and moving to California to stake our claim.

The decision to leave this job was tough but feels right. I’ll desperately miss the news business, where I’ve worked for a decade now, even with short deadlines and huge projects that are over before they’ve even really had a chance to get going (ask me in six months if I really miss election coverage). More than that, I’ll miss the brilliant people that make it happen every minute of every day. Msnbc.com in particular has an incredible future ahead of it, with some of the smartest, most motivated and forward-thinking people in the industry. I’m going to be sad not to be involved in the amazing work that’s coming soon and miss solving the world’s problems with that crew. I hope they think half as highly of me as I do of them.

Leaving Seattle is going to be just as, if not, harder. I’ve lived here longer than anywhere in my life – even the town and house I “grew up in” was a six-year stint. I love my southern roots dearly and I love the Pacific Northwest just as much, different though they may be. Seattle’s the first place I’ve chosen to live that feels like home. The friends we’ve made here are some of the most wonderful I’ve come across anywhere – that I won’t be able to just run out and meet them is going to hurt. We’ll be an $80 flight away, though, and you guys are more than welcome whenever you forget what the sun looks like or need to trade Starbucks-swilling yuppies for Blue Bottle-sipping hipsters.

Tough as the decision to move on and away has been, we are so excited for what lies ahead. I’m honored that the folks at Mule would have me – they’ve been building something truly amazing for the past ten years, something that I’ve admired from afar for a little while now, and I can’t believe I get to be a part of that in just a few days. They do such great work for some truly outstanding clients and I’m just beside myself that they think I’m good enough to help them out. Bonus: every Friday, Permenter and I will have a Southern Gentlemen dress-up contest we’re preliminarily calling “seersucker this!”, though that name might need some tweaking – look for it on Instagram.

More than anything, I’m looking forward to this new adventure with my new wife (!!). We’re going to be starting our lives together in a new place with new careers and ambitions. I don’t doubt for a second that it’s going to be challenging and exhausting and thrilling and incredible. I can’t wait.

This American Life takes on software patents and they do a great job of it. And kudos to Chris Sacca for having the stones to call out the oft-celebrated fraud Nathan Myhrvold and his terrible Intellectual Ventures.

I used to get optimistic when I’d see stories like this appear in more mainstream media sources. Most nerds have known for years that software patents are a terrible idea but now non-geeks can start to understand. Unfortunately, it’s not an issue enough people care about to affect any real change, especially when people like Myhrvold can write a few op-eds and throw a few millions at politicians to maintain the status quo. I expect this problem to only get worse.

Myhrvold is happy to see patent portfolios like Nortel’s being bid up because it increases his own company’s value with its thousands of patents. This is an arms-dealer applauding the outbreak of hostilities, meanwhile pointing to people making war-like faces on the sidelines. (Whoa, watch out for those guys!) This is far, far from a disinterested observer of a fundamentally broken U.S. software patent system. Let’s end the deference.

—Paul Kedrosky says Nathan Myhrvold is full of shit about software patents.